Table of Contents

- SMCI stock price analysis: Is Super Micro Computer a bargain? | Invezz

- SMCI Stock: Supermicro Stock Surges | Investor's Business Daily

- SMCI Stock Analysis | 0 By Friday? SMCI Price Prediction | Super ...

- SMCI Stock Price Prediction News Today 20 January - Super Micro ...

- Why Another Crash Could Occur | Seeking Alpha

- SMCI Stock Soars. What's Next for Super Micro Delisting Fears After ...

- Super Micro Computer, Inc. | $SMCI Stock | Shares Drop On Poor Guidance ...

- SMCI Stock Price Prediction News Today 15 March - Super Micro Computer ...

- Is Super Micro Computer (SMCI) a Great Stock for Value Investors?

- SMCI Stock Price: How Emerging Technologies Shape Its Value? - TechBullion

Company Overview

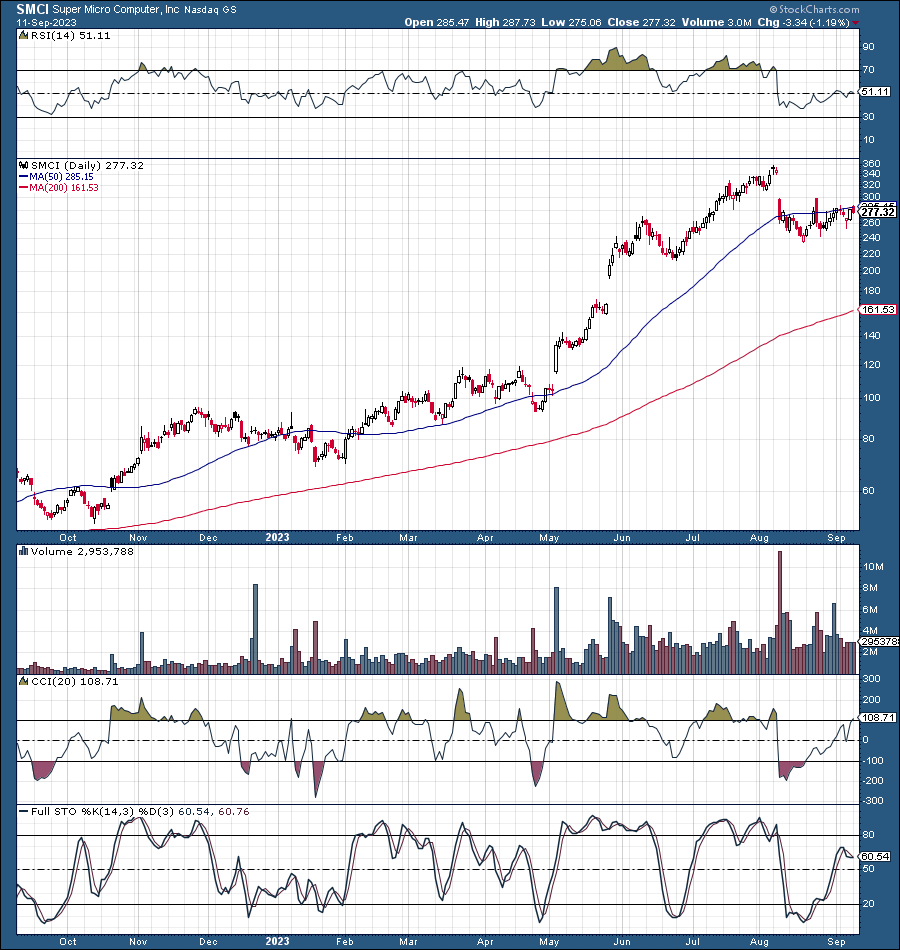

Real-Time Stock Performance

Key Drivers of Growth

Several factors have contributed to the growth of SMCI common stock in recent times. Some of the key drivers include: Increasing Demand for Cloud Computing: The shift towards cloud computing has led to a surge in demand for high-performance servers and storage solutions, which is a key area of expertise for SMCI. Artificial Intelligence and Machine Learning: The growing adoption of AI and ML technologies has created new opportunities for SMCI, as its products are well-suited to support the complex computational requirements of these applications. 5G Network Deployment: The rollout of 5G networks is expected to drive demand for high-performance computing solutions, which will benefit SMCI's business.

Investment Prospects

With its strong product portfolio, growing demand, and increasing revenue, SMCI common stock presents an attractive investment opportunity for those looking to capitalize on the growth of the technology sector. The company's commitment to innovation and customer satisfaction has earned it a loyal customer base, which is expected to drive long-term growth.

Risk Factors

As with any investment, there are risks associated with SMCI common stock. Some of the key risk factors include: Intense Competition: The technology sector is highly competitive, and SMCI faces competition from established players such as Dell, HP, and IBM. Regulatory Risks: Changes in government regulations and trade policies can impact SMCI's business and stock price. In conclusion, Super Micro Computer, Inc. common stock (SMCI) is a compelling investment opportunity for those looking to tap into the growth of the technology sector. With its strong product portfolio, growing demand, and increasing revenue, SMCI is well-positioned to capitalize on the trends driving the industry. While there are risks associated with the investment, the company's commitment to innovation and customer satisfaction makes it an attractive option for long-term investors. As the technology sector continues to evolve, SMCI common stock is definitely worth keeping an eye on.Disclaimer: This article is for informational purposes only and should not be considered as investment advice. Investors are advised to conduct their own research and consult with a financial advisor before making any investment decisions.